Recently, there have been an increasing number of Hawaiians installing solar energy systems. Fundamentally, most Hawaiians are going solar to curb the high utility bills that rely on grid electricity.

Also, Aloha State enjoys some notable investment tax credits for solar installations.

But do they apply to all Hawaiians, and what are the terms for the solar incentives?

Join us as we delve deep into the Hawaii solar tax credits.

Federal Solar Investment Tax Credit

Solar Installation is Cheap with the Federal Tax Credit

In the US, you are eligible for federal tax credits on all the solar panel installations you make before 2032. This subsidy will apply to 30% of your solar systems installation costs, including labor and equipment costs.

Therefore, for instance, your solar system costs $26,000. In this case, you are eligible to excise tax exemptions of 30% of the principal amount. Hence, your federal taxes exemption will be $7 800.

Also noteworthy, the 30% federal income taxes credit applies up until 2032. After 2032, the maximum federal credit will fall back to 26%.

Primarily this is to encourage all Americans to shift to clean energy sources as the country gradually moves away from fossil fuels reliance.

Hawaii Solar Tax Credits and Rebates

As we’ll see below, several incentives exist for installing solar panels in your home.

Renewable Energy Technologies Income Tax Credit (RETITC)

The Hawaii RETITC program significantly lowers costs

This incentive is the tiebreaker that separates Hawaii from other states regarding solar installations. In addition to the 26% federal tax credit (30% if you install rooftop solar before 2032), Hawaii’s 35% solar tax credit is also available.

Nonetheless, the ‘renewable energy technologies income tax credit’ has a $5,000 per 5 kW system cap. But it’s still worthwhile as you’ll cumulatively save a significant amount. For instance, take the previous example of a solar customer who spends $26,000 on installation.

First, the customer will benefit from the 30% Federal Tax Credit (30% x $26,000) plus $5,000. In total, such a customer will save $7,800 + $5,000 = $12,800. This will significantly lower the average cost of installation.

Hawaii Solar Tax Credits: Hawaii Solar Property Tax Exemption

Hawaii doesn’t have a solar property tax exemption

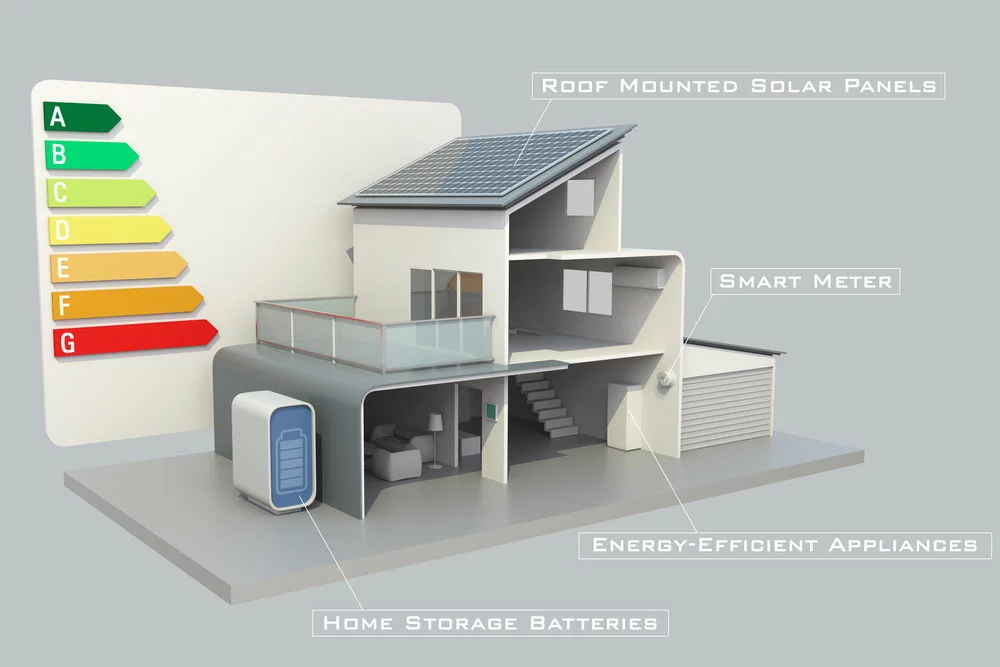

Installing solar panels in Hawaii will save you hundreds of dollars in electricity costs. In addition, the photovoltaic systems will boost your property value, meaning your property tax will also soar.

In some states, there are property sales tax exemptions for such increases in value resulting in Solar installations. However, these don’t apply in Hawaii.

So your savings on overall electric bills result in more taxes, right? Well, not necessarily, especially if you live in Honolulu. Residents of Honolulu city have an additional rebate on solar installations of 100% property tax exemption for 25 years.

Notably, this applies only to qualified customers in Honolulu City, where about 70% of Hawaiians live.

Green Energy Money Saver Program (GEMS)

Low-income homeowners can also benefit from the Green Energy Market Securitization (GEMS) loan program. The qualified customers are Hawaii energy co customers with at most 140% of the average area’s median income.

Under this program, you can have solar installers set your solar battery and panels at zero costs.

Hawaii Solar Tax Credits: Net Energy Metering in Hawaii

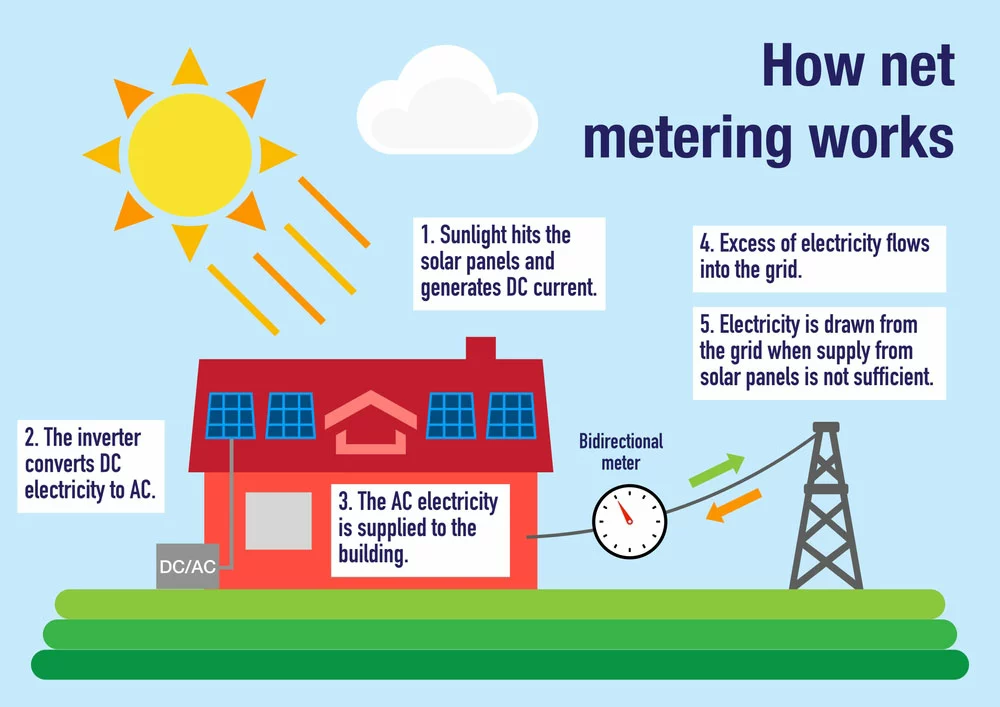

A net energy metering illustration

Some states have a net metering program under which consumers get credit for their surplus electricity. Also, the credit requirements vary from one state to the other. However, Hawaii no longer provides the net metering option.

Instead, Hawaii Energy gives their consumers either the Customer Self Supply or Customer Grid Supply choice.

a.) Customer Self Supply

Under this option, you need an energy storage option (battery storage) from which you can use all your solar energy. This independent energy option is essential when you don’t have a surplus.

b.) Customer Grid Supply

Alternatively, send all your solar energy to Hawaii Energy can opt for this option. In turn, HECO will supply your energy needs lower than the retail price.

Hawaii Solar Tax Credits: Hawaii Solar Panel Costs

The cost of solar power is remarkably cheap in Hawaii

The solar prices vary depending on the number of panels you install. On average, a 6kW system will cost approximately $2.67 per watt. It is relatively lower than the average US residential power systems cost of $3.00 per watt.

Applying the 26% Federal Investment Tax Credit and Hawaii Energy Tax Credit will significantly reduce costs.

Hawaii Solar Tax Credits: Why Hawaii Is a Solar Paradise

A Solar Panels Plant

If you’re a Hawaii resident, you can save a lot on energy bills if you opt for renewable energy sources like solar. For instance, on average, Hawaii’s renewable energy services are twice as cost-effective as other states.

Also, Hawaii has significantly dropped solar panel prices over the last five years. Further, under the Hawaii Clean Energy Initiative (HCEI) program, Hawaii targets to deliver 100% of their from renewable sources by 2045.

This progress, coupled with solar renewable energy credits by utility companies, will continually lower electricity rates. Hence, if you’re in Hawaii, it’s the ideal time to take advantage of the cash incentives and rebates in the solar industry.

How to Choose the Best Hawaii Solar Panel Company

Many Solar Panels

Solar customers in Hawaii or any other state will come across many solar panel companies offering installation services. Here are tips for settling on the one that best fits your needs.

Check the solar panel efficiencies

Solar panel performance rating

Different companies offer panels with various features. Hence to know the best, have a complete list of critical checkpoints before purchase. For instance, consider the panels’ features such as the following:

- Power Tolerance

- Output capacity

- Temperature coefficient

- Energy storage provisions

- Overall efficiency

- Power rating

Manufacturer Quality

It is also imperative to compare equipment durabilities across various solar companies and their respective assurances and warranties. Besides, check out the durability of the solar panels concerning the individual circumstance of your residential area.

For instance, if you live in a hail-prone setting, you should buy solar panels capable of withstanding hailstorms.

Installation Prowess

Again, there’re many installation companies, and you need to go for one with minimal installation costs without compromising the quality of work. Also, an ideal solar installer should know about energy improvements to your solar systems.

Local Incentives

Lastly, go for a company with solar credit subsidy options. Installation under large solar companies will cost you significantly less than with small companies.

FAQs

What are the benefits of going solar in Hawaii?

First, going solar lowers energy bills while also embracing using clean energy sources. Besides, installing solar systems attracts the 35% Hawaii Energy Tax Credit and 26% federal tax credit. In the long run, these will significantly lower solar energy costs.

Should I buy or lease my solar panels?

If you own the home, buying solar panels is more viable than leasing them. If you have rented the space, you can access community solar. Alternatively, you can lease panels for the duration of your tenancy.

Summary

If you are in Hawaii, solar installation has loads of benefits. The average cost of solar installation is low when you take the tax credits, and overall it’ll save you a lot in monthly payments for electricity bills.

Nonetheless, the tax credits are subject to change, so you should consult the local authorities for updated tax advice on solar.

Otherwise, there should be nothing to hold you back as you go solar.