If you are a home or business owner who has decided to go green and invest in solar, you’re heading in the right direction. But making that decision is the easy part. Solar is not cheap. You will have to pay a significant sum to harness the sun’s power. But there is a workaround. Solar lease vs. PPA (power purchase agreements) can get you solar energy without investing a big chunk of your money. In this article, we will compare solar lease vs. PPA to show you the options each agreement gives you. Take a look!

What is a Solar Lease?

Also referred to as a solar service agreement, a solar lease allows customers to bypass the upfront costs of buying and installing solar panels. Instead, the customers make monthly lease payments to power their homes using solar energy.

The lease agreement gives the solar company ownership of the solar panels. But you can use all the electricity generated from the solar panels on your roof.

Solar panels on a tiled roof

Leases take anywhere from 10-25 years, and you pay a fixed amount each month regardless of the power generated by the solar system.

The solar lease payments are usually less than what you pay as the average electric utility bill monthly. Therefore, you should start saving from day one.

When the lease expires, you have the following options.

- Renewing the lease

- Let the leasing company take their panels

- Purchase the solar panels at the current market value

Pros and Cons of a Solar Lease

Pros

- Zero upfront costs

- Maintenance costs are the solar leasing company’s responsibility

- Low energy bills during the lease period

Cons

- The cost savings are lower than when purchasing the panels

- Must make monthly payments

- You cannot sell excess energy back to the grid

- Not eligible for the federal tax credit, state, and local incentives

- Selling your home before the lease expires means the new owners must inherit the monthly payments

What is a Solar PPA?

A solar PPA (Power Purchase Agreement) is another way of investing in solar energy without paying for the panels upfront. But in this agreement, you don’t pay fixed monthly payments.

Solar panels being installed on a roof

Instead, the solar installer charges the monthly costs based on the power the solar panels generate to run your home. The solar company usually offers a fixed rate for every kWh (kilowatt-hour) the panels produce, which is cheaper than what you get from the utility company.

Pros and Cons of a Solar PPA

Pros

- Low energy costs per kWh

- Zero upfront, maintenance, and repair costs

- Less financial risk

Cons

- Not eligible for rebates or tax incentives

- Payments will be higher when the panels generate more electricity

- Lower cost savings compared to buying the panels

Features of Solar Leases and PPAs

Solar PPA and lease contracts have several similarities, which include the following.

Zero Upfront Costs

You do not pay for the solar panels or installation costs in either of the contracts. The solar company takes care of these costs. However, they maintain ownership of the products.

No Maintenance or Repair Costs

The solar installer is also responsible for maintaining, repairing, and monitoring the system over the contract period.

A maintenance engineer inspecting a solar panel

Monthly Payments

Nothing comes for free. Instead of paying purchase and installation costs, you make monthly payments to the solar company for the service given by the solar panels. These payments are usually lower than the cost of utility company electricity.

Long-Term Solar Contracts

Solar lease terms and PPAs are long-term contracts that allow the solar installer to recover the investment slowly over time. Lease companies can give shorter terms ranging from 10-25 years. However, PPA contracts can last anywhere from 20-25 years.

You can renew the contract, purchase the solar panels, or let the solar company take their solar panels when the time lapses. Also, you can buy the system during the lease or PPA period at the market price or a price defined in the contract (whichever is higher).

Solar panels on a roof on a sunny day

Price Escalation

The monthly payments for PPA or solar lease agreements increase annually. The agreement usually defines this increase, which can be between 3% and 5%. Therefore, a long-term contract might be expensive during the final years.

Uncertainty When Selling Your Home

If you want to sell your home, it is possible to transfer the solar financing agreement to the new owner. However, these agreement conditions will make it harder to sell the property because not everyone will find economic sense in the solar financing model.

Solar Lease vs. PPA: Differences Between a Solar Lease and PPA

A solar lease gives you an equipment rental and performance agreement. Therefore, you will pay a flat fee monthly until the contract expires. These payments are usually lower than utility bills. But the actual lease payments depend on several factors, such as the following.

- System size

- Installer

- Your location

On the other hand, a solar power purchase agreement is an energy contract that operates more like your utility bill. In this contract, the homeowner pays for the kWh the solar energy system produces. So the monthly payments will vary, and you will pay more during the hot summer months when the panels generate more power.

However, the solar electric rates are usually lower than the utility company rates per kWh. But the actual energy rates will depend on the following.

- Your location

- Price of electricity

- Installer

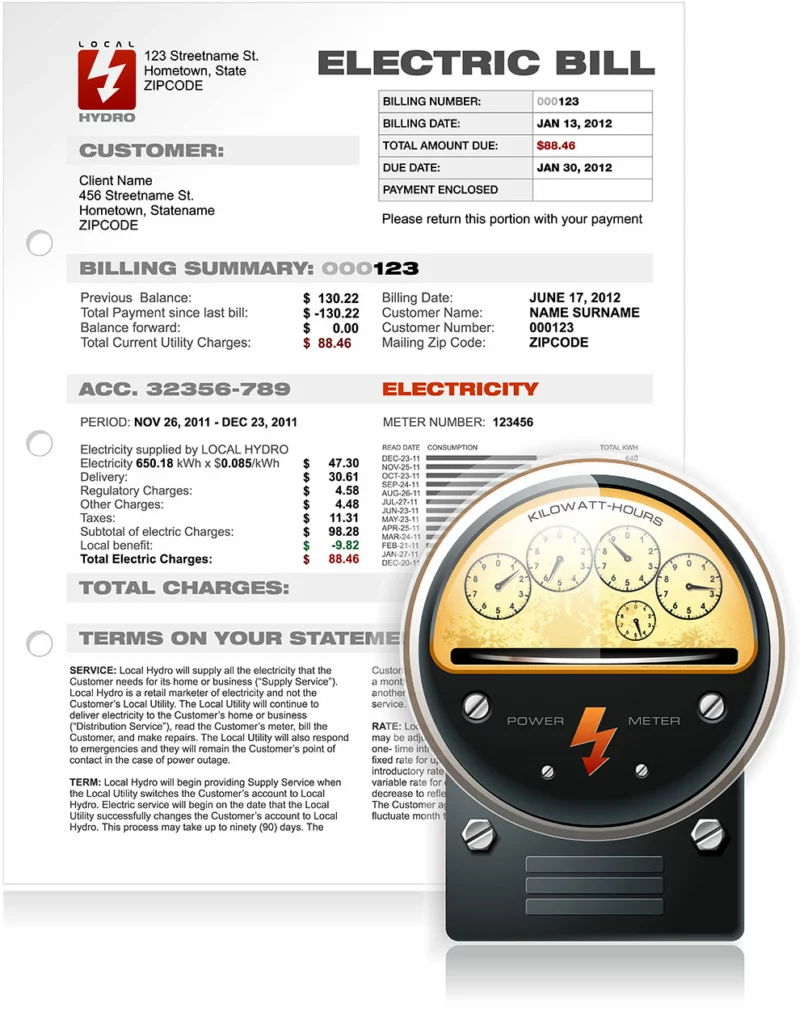

An electric utility bill

Can You Use Solar Tax Credits if Financing Your System Using a Lease or PPA?

No. At least not directly. The solar panels are not yours. So you cannot apply for these incentives and tax credits. But the solar provider is eligible to receive them. Most companies use these solar incentives and tax credits to build and maintain the solar panels on your roof.

A solar panel technician drill installing a solar on a roof

However, you won’t have any say or control over the incentives and tax credits they apply for or how they use them. But you can contact your installer to ask them about the tax credits and incentives they are using.

Solar Lease vs. PPA: Which Is Better?

It depends. The most significant factor is cost, so you should consider your location.

Location

The panels will generate more energy if you live in a sunny state. Therefore, a PPA will cost more. In such a case, a lease might be better. But a PPA might be better if you live in states that have few sunny months. Consider this 7 kW system in Massachusetts that covers an entire household’s electricity consumption.

| Month | Solar Power Production (kWh) | Lease Payment (Flat Rate) | PPA Payment ($0.15/kWh) |

| January | 321 | $96.60 | $48.15 |

| February | 366 | $96.60 | $54.90 |

| March | 500 | $96.60 | $75.00 |

| April | 728 | $96.60 | $109.20 |

| May | 865 | $96.60 | $129.75 |

| June | 1094 | $96.60 | $164.10 |

| July | 1004 | $96.60 | $50.60 |

| August | 964 | $96.60 | $144.60 |

| September | 823 | $96.60 | $123.45 |

| October | 507 | $96.60 | $76.05 |

| November | 327 | $96.60 | $49.05 |

| December | 272 | $96.60 | $40.8 |

| Total | 7771 | $1159.20 | $1165.65 |

| Average Monthly Payment | $96.60 | $97.14 |

In such a case, the cost difference is negligible, so the choice between the two should come down to personal preference. The advantage of leasing is that you can calculate and know the required monthly payments beforehand. You cannot do the same with PPA. But with PPA, you pay for what you generate.

Incentives/Tax Credits

Besides this, nonprofits and government entities, like schools and housing authorities, cannot take advantage of federal, state, or local incentives and tax credits. Therefore, such institutions should consider PPAs and leases.

But homeowners and private companies have a better option. Leases and PPAs are more expensive than buying in the long run. If you or your company can afford to buy the solar system, it will be cheaper, and you will qualify for the tax credits and incentives.

Solar panels on a factory rooftop

Alternatively, you can apply for low-interest solar loans. But if the terms of PPAs and lease agreements suit you, do a rough cost estimate for the entire year to determine which option is cheaper.

Wrap Up

In conclusion, PPA and solar lease agreements have several benefits, the most significant being zero upfront costs. However, their terms and payments differ, so comparing the two is necessary to make an informed decision. This article breaks it down for you, and we hope it has been insightful. If you have any questions or comments, leave a message, and we’ll get back to you asap.